Despite how simple it may seem, setting up credit card processing can be confusing and overwhelming. While a customer entering credit card information and getting approved for a purchase seems like a simple process, it’s actually made up of a complex series of events. A single transaction involves multiple steps and several layers of involvement behind the scenes. A great deal of paperwork can also be involved during the initial setup process.

Get a Merchant Account

Assuming you already have a checking account through your bank, a merchant account will be critical. A merchant account is a sort of contract between your business and a credit card processing company. Since your bank doesn’t actually process credit cards, a merchant account will securely connect you to the credit card processing network. A merchant account does function similar to a bank account and having one will give your funds somewhere to go so that you can get paid. Make sure that your merchant account is internet-enabled and will also play well with the most frequently used payment gateways.

Once a sale has been successfully approved, money gets transferred to your merchant account. It’s like a holding tank for your credit card sales. When the funds have been deposited into your merchant account, they’ll get transferred to your usual business bank account within a few days and can finally be withdrawn.

Set Up a Payment Gateway

The next thing you’ll need to do if you’re accepting credit cards through your online retail store is choosing and set up a payment gateway. A payment gateway transfers information between a “payment portal” (like a website or smartphone) and an acquiring bank.A payment gateway allows a private, secure conversation between your website and your customer’s bank, and at the end of the process, money will be transferred from your customer’s credit card to your own merchant account. Having a payment gateway validate the payment information for you avoids any potential issues caused by expired credit cards, stolen credit cards, or insufficient funds. You can be sure you’re getting paid.

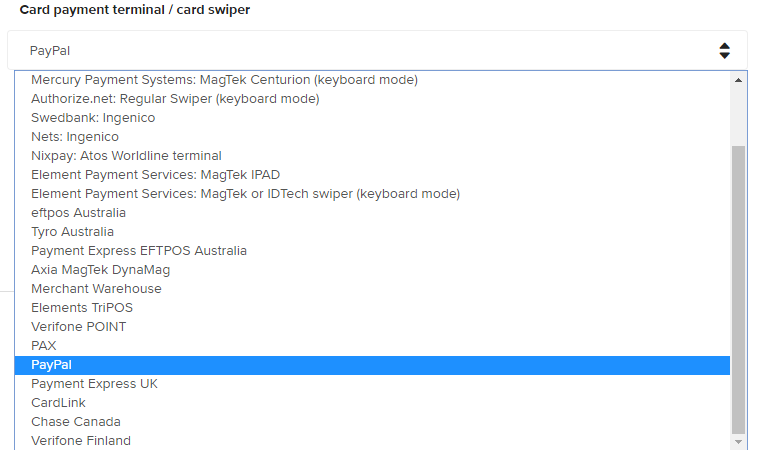

A payment gateway also directly encrypts transaction data from your customer's internet browser, keeping required security in place while also keeping your customer on your website. The smoother your customer’s experience, the greater the likelihood that your customer will complete the purchase. Erply has a built-in integrated payments option, so you can work with various

payment providers

and hardware devices to ensure a streamlined customer purchase experience.

If you’re using a shopping cart application on your website, for example, your payment gateway will handle all the credit card information so that your shopping cart doesn’t have to. Once the transaction is approved and complete, your customer sees they’re right back in your shopping cart on your site.

If you’re using a shopping cart application on your website, for example, your payment gateway will handle all the credit card information so that your shopping cart doesn’t have to. Once the transaction is approved and complete, your customer sees they’re right back in your shopping cart on your site.A Series of Fortunate Events

Once you’ve got your payment gateway ready to go, here’s a basic step-by-step summary of what happens during the first few seconds after your customer submits an order on your website:

Your customer:

Your customer will make a purchase on your website (or in your store) by entering credit card information.

The payment gateway:

Your payment gateway will send the information securely to the internet merchant account (processor).

The processor:

The processor will send the transaction to the relevant credit card association such as Visa, MasterCard, Discover, or American Express.

That credit card association will then send the information to the specific bank associated with your buyer’s card.

The customer’s bank:

That issuing bank (or the card association itself, in the case of Discover and American Express) will either approve or decline the transaction, based on your customer’s available funds and credit limit.

That same bank will then pass the approval or denial back to the credit card network.

The credit card network:

The credit card network takes that information and returns it to your bank processor (merchant account).

The processor:

The processor sends that decision back to your payment gateway.

The payment gateway:

Your payment gateway will store the transaction results and reveal the decision to both you and your customer via your website.

Your store:

You deliver your customer’s order.

Your customer’s bank:

The bank that issued the credit card delivers the funds for the sale to the credit card network.

The credit card network:

The credit card network then delivers the funds to your bank.

Your bank:

Finally, your bank deposits the funds into your merchant account. This “settlement” step usually occurs between two and four business days after the transaction occurred on your website.

What Does All of This Cost You?

A merchant account will require an initial setup fee, recurring monthly fees, and transaction fees. These fees are usually applied per transaction, and often based on a percentage of the sale itself.A payment gateway will also require an initial setup fee (up to $200), a recurring monthly fee ($20-$60) and a relatively low per transaction fee. If you’re receiving a high volume of orders through your website, you can often reduce the per transaction charges by paying a higher monthly fee instead.

And there you have it! Though there are multiple parties involved, and at first glance, it seems complicated, credit card payment processing is just a logical series of transactions resulting in a smoother shopping experience for everyone involved.