On the one hand, retail businesses feel a lot of pressure on wages. The sector provides job to millions

: in February 2019, the US retail sector employed 15.8 million people and the average hourly wage was $16.3. While the number of employees has remained relatively the same over the past few years, hourly wage is increasing at a constantly growing rate: a year ago in February the wage fell at $15.52 and in February 2017 it was $15.24

. By the way, 1.2 million retail employees, i.e. every seventh person employed in the sector, lost their job during the last crisis in 2008–2010. This goes to show how much retail influences the economy as a whole and how problems in the sector affect all of us.

Another problem that many standard storekeepers struggle with is real estate related payments and loans. Increasingly more businesses are falling behind on payments – a situation that proves fateful to many. The onslaught of online commerce and changing retail business models also play an important role. Retail giant Sears is one of several well-known brands that have closed many of their stores in recent months; others include J.C. Penney, Macy’s, Toys “R” Us, etc.

Customers Weighed Down by Credit Debt

There’s a third threat that might bring about a maelstrom that won’t only affect retail but also banking. We’re talking about retail store credit cards that large store chains, car dealerships, tourism and service related companies, precious goods stores, etc. are generously handing out. Bloomberg admits that retail store credit cards are proving just as big a problem as retail businesses struggling economically and online stores robbing brick-and-mortar stores of buyers. Those issuing retail credit cards are struggling with a growing number of payment delays because customers falsely think that if a store closes or goes bankrupt, their account will become inactive and they no longer have to repay the used credit.

International credit and economic analysis firm Equifax warns that people don’t repay their credit for stores that have closed or gone bankrupt because many fail to understand that although the retail business is struggling the credit debt remains valid.

Equifax’s summaries from last year reveal that the number of retail credit card payments that are 60+ days late is constantly increasing and, in March last year, made up 4.65% of credit cards, i.e. 57 basis points higher than at the same time the year before.Bloomberg adds that card companies are already making preparations – e.g. the largest private label card issuer Synchrony Financial increased its reserves the year before the last to cover its ever-increasing losses.

Retail Loyalty Cards: A Tempting and Simple Choice

A retail credit card functions just like any other credit card issued by a bank. However, from the customer’s perspective the former is basically consumer credit that’s not particularly cheap. Then again, it’s much easier for a customer to get a retail credit card than a bank alternative, making it especially tempting for people with a bad or brief credit history to help them improve their credit rating.A survey by credit and economic analysis firm Experian revealed that 62% of respondents had one to five credit cards with three being most common. The average credit card debt was $ 2,326.71 with a monthly payment of $ 799.83.

Why Do Customers Like Your Store’s Credit Card?

As we’ve learned, store credit cards are primarily preferred by people with bad or nonexistent credit histories. That’s the catch – these cards are used by people who can’t get a credit card from the bank for some reason or other.

However, for the majority of consumers, retail credit cards are first and foremost related to consumer habits and comfort – why shouldn’t you have a loyalty card that also functions as a credit card at your favorite store?

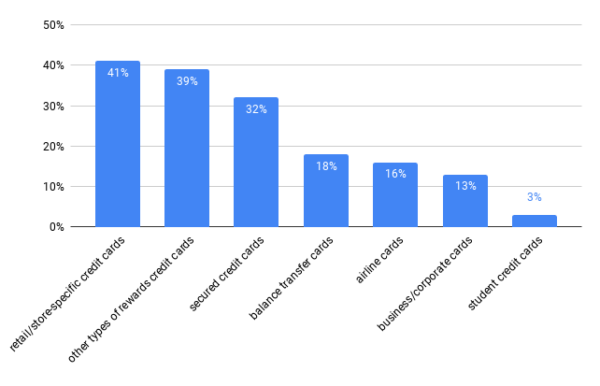

Popular Credit Cards

Source: Experian

According to Experian, credit cards are most often used to avoid paying in cash (38%), to get discounts (36%) and to create a credit history (34%). Timely payments allow the customer to increase their credit level and, depending on the monthly payment, speed up the improvement of their credit score. However, ignoring payments can have a detrimental effect on credit report results, making it harder to get new cards later on and imposing harsher loan terms.

Retail Credit Cards Have Several Advantages…

- They normally have no annual fees;

- New cards often have a 0-interest period;

- They usually have a longer than average payment deadline;

- They’re accessible to customers with a lower credit rating;

- In addition to credit, they also grant access to the store’s benefits – discounts, premiums, bonuses, reductions;

- They may be linked to a number of brands and stores;

- If the card is issued in collaboration with Visa, MasterCard or American Express, the customer won’t be limited to a single retail chain but can use the card everywhere;

- Ideal for rewarding a loyal customer;

- A great option for a customer seeking to improve their credit rating;

- The retail business can play around with bonuses, e.g. transfer a sum of money to a new card as a gift.

…And Far Fewer (but Significant) Disadvantages

- While the interest for a standard credit card is around 12–14%, the average retail credit card interest is somewhat higher, landing at around 17–25%;

- If the customer doesn’t have great financial habits and fails to repay the entire sum every month, the interest quickly piles up;

- Retail credit cards motivate people to make more emotion based and irrational purchases;

- A credit card tied to a single retail chain or business doesn’t allow for freedom of choice;

- People with limited financial discipline can fall into a payday loan cycle.

What Can a Merchant Do to Minimize His Own and the Customer’s Risks?

Contemporary POS software offers retail businesses with methods that are financially much more secure than consumer credit based cards – for example bonus points, prizes, rewards and campaigns. Plus, you can combine all available options. Check out all the options Erply provides

.

POS software makes it easy to create an exclusive customer reward system and offer a no-risk loyalty card with endless discount options from campaigns to personal offers to your customer.

It’s worthwhile to consider possible partnerships with other businesses for shared discounts and campaigns, joint services, apps and (mobile) payments, and why not parking discounts. You and your partners can complement each other, share investments and create a loyalty card to substitute bankcards with steep interest rates and offer personal value. That’s one worry less when reading news about an impending crisis and a way for you to maintain your business and a happy customer base.

Read our blog post on CRM.